InsurTech? Quite simply the combination of the words “insurance” and “technology”. InsurTech, much like our beloved FinTech, aims to disrupt and revolutionize an industry stuck in its ways. Insurance is a traditionally stagnant industry but InsurTechs are rapidly changing that image.

This shift echoes that of the traditional banking market. The innovation coming from Tech-led businesses in the last few years has completely shifted the landscape and interest in Digital Banking. No longer does the consumer just check their statement at an ATM every week or so, Neobanks are on every phone screen and you can check balances, create budgets, share bills and invest at the tap of a finger.

Well… InsurTechs have well and truly disrupted the insurance industry and are making a very stuffy sector (dare we say it) cool.

So let’s take a look at some InsurTech insights; the companies teaching old dogs new tricks. In particular, this article will be looking at the European InsurTech market and its growth over the last years.

InsurTech Insights: Funding

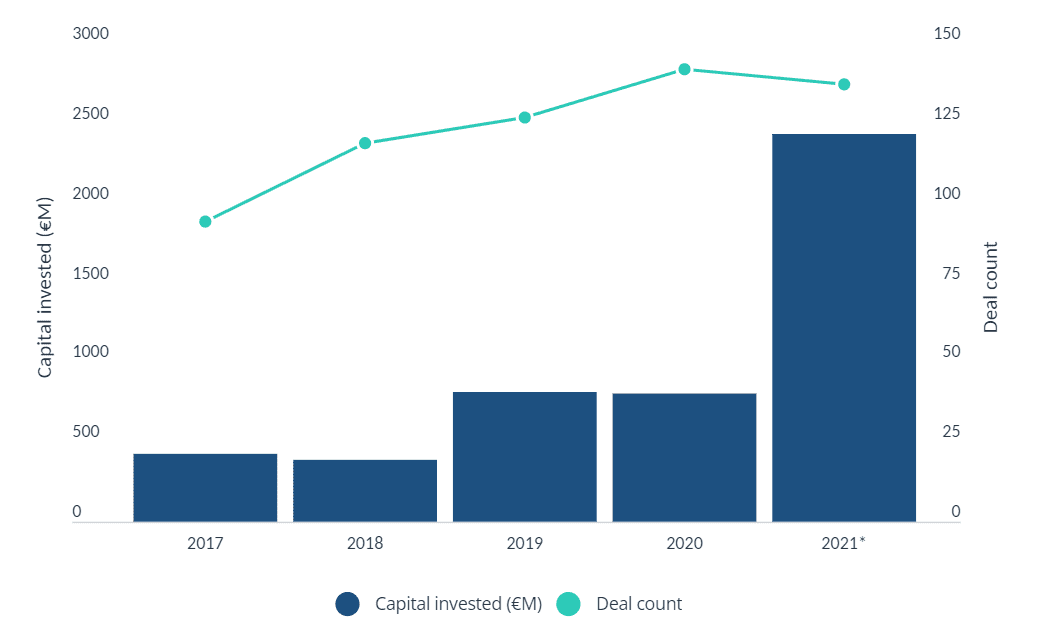

Let’s start big, everybody loves a bit of funding and what the European InsurTechs have raked in over the last year is truly mind-blowing. For the first time in 2021 the industry funding surpassed €1 billion, but wait, the European InsurTechs did not stop there. As of the end of November 2021, they accumulated a total deal value of €2.43 billion, which is already over 202% from €802.3 million in 2020.

Here is one more jaw-dropping stat for our Funding Fans, the European InsurTech market became the second most funded market in the space, behind the US, in 2021. InsurTechs in Europe accounted for a whopping 26.9% of the capital invested. In 2020, this stood at 15.6%.

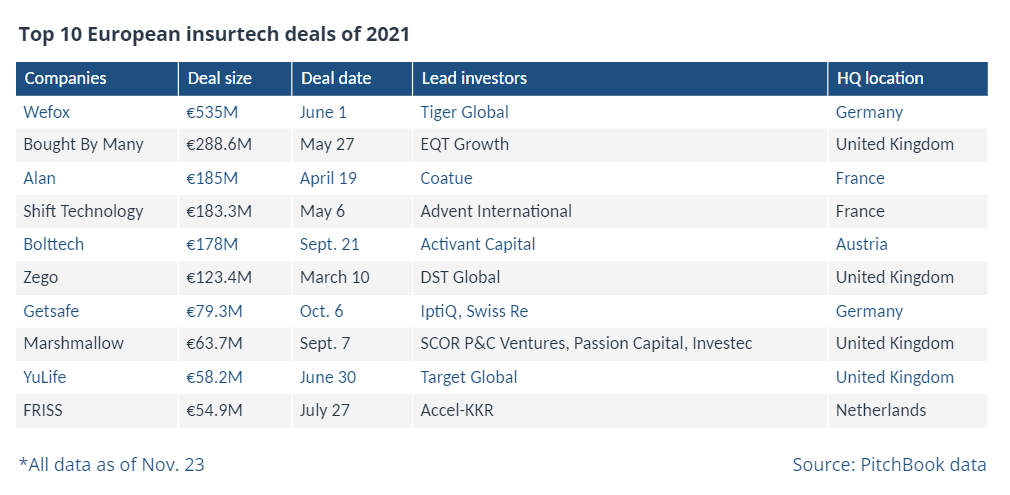

The below images are a great visual representation of the amount of capital that was injected into the European InsurTech market.

(PitchBook, November 2021)

(PitchBook, November 2021)

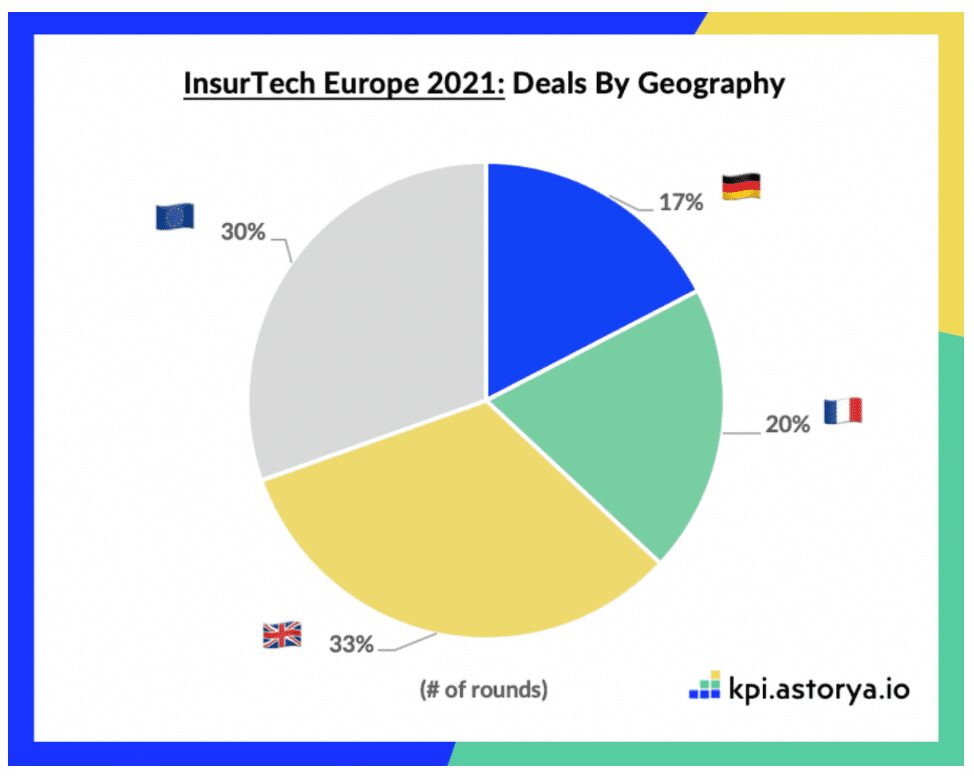

Furthermore, let’s take a look at the geographical breakdown of where the majority of the InsurTech deals in Europe occurred. The pie chart shows that 3 European countries, in particular, are at the forefront of the industry’s growth (UK, France, and Germany).

(Found on tech.eu, January 2022)

(Found on tech.eu, January 2022)

InsurTech Insights: Unicorns; The Startup Champions League

InsurTech Europe produced some incredible numbers over the last year and 2021 was truly a record-setting year for the space. It is worth taking a closer look at the InsurTechs leading the charge and playing in a league of their own, the unicorns.

At the end of 2020, InsurTech Europe had 0 unicorns. One year later, we are fortunate to have 8 InsurTech startups that are valued at over $1 billion.

Here is the list:

- wefox

- Berlin, Germany

- Founded in 2015

- Valued at $3 billion

- Digital insurance

- Bought By Many

- London, England

- Founded in 2012

- Valued at $2 billion

- Pet insurance

- Shift Technology

- Paris, France

- Founded in 2013

- Valued at $1 billion

- Provider of AI-driven decision automation and optimization technology for the global insurance industry

- alan

- Paris, France

- Founded in 2016

- Valued at $1.67 billion

- Digital health insurance platform that offers insurance services by focusing on a price-quality ratio health plan

- Zego

- London, England

- Founded in 2016

- Valued at $1.1 billion

- Commercial motor insurance provider

- CLARK

- Frankfurt, Germany

- Founded in 2015

- Valued at $1 billion +

- Insurance platform that provides full insurance cover

- Tractable

- London, England

- Founded in 2014

- Valued at $1 billion

- Develops artificial intelligence for accident and disaster recovery

- marshmallow

- London, England

- Founded in 2017

- Valued at $1.25 billion

- Car insurance

InsurTech Insights: The Investors

Having looked into the major players in the European InsurTech scene, it is also worth having a look at the investors injecting capital into the industry. The image down below provides an insight into the investors who got involved in the first half of 2021 and at what funding stages they stepped in.

(Found on tech.eu, July 2021)

(Found on tech.eu, July 2021)

If you are an InsurTech looking to raise some money, here is an article on How To Create An Investment Deck To Impress VCs.

InsurTech Insights: Trends for 2022

With the tremendous growth that European InsurTechs have made in 2021 and with all the money that has been pumped into the industry, we expect 2022 to be another terrific year for InsurTech Europe. Considering how the sector has skyrocketed over the last couple of years, its 2022 InsurTech trends are deserving of a whole separate article.

Your Partner in Growth

As the InsurTech industry continues to grow, so does the need for talent to facilitate this. At Storm2 we have not only specialized in FinTech headhunting but also on InsurTech recruitment. We strive to connect senior talent with disruptive players such as yourself. We are able to assist in any stage of your growth by connecting you with the right people. Please don’t hesitate to get in touch and we would be more than happy to see how we can help and support you in your journey.