Oh snap…here we go again…it’s that time of the week where an insights article pops up on the website…

At this point, you probably know the Spiel…how the article is structured and what to expect. Drum roll please, here comes the surprise…I’m joking…what is WealthTech?

Wealth meet Technology, it’s that simple. You could probably write a whole separate article on What is WealthTech? Oh wait, we did. All jokes aside, at this point you have probably come across a robo-advisor, an investing/savings app, or a digital broker, these are all prime examples of WealthTechs and have significantly grown in popularity. Not all too long ago investing meant scheduling an appointment with a financial advisor at your local bank or seeking out a company specialized in investing. Fast forward to today, and consumers have an abundance of investing and savings apps available to them at the click of a download button.

Personal example: not all too long ago I set out to set up an investment account for myself. First thought, I’ll do this at my local bank, they have a pretty good investing track record. So I went through the whole appointment procedure and two Skype calls later, I had my account set up. Having tasted investing blood, I did a few Google searches and came across robo-advisors, in particular Scalable Capital {free shoutout). Did a bit of research and found myself in the signup process. It took about a fraction of the time to set up vs my local bank, the process occurred in the app and you guessed it, it all happened from the comfort of my famous FinTech couch.

Point is, WealthTechs have made investing and/or saving accessible to your everyday Joe. Not only because the majority have a mobile app, but they remove the barriers to entry and almost make us feel comfortable with the risk associated with investing. Spotlight Marketing and Product Design teams. WealthTech Marketing teams are producing content that makes understanding investing and saving as easy as your ABCs. Product Design teams are turning fighter jet-looking charts into mobile apps that have the user interface and experience of a Digital Bank. No surprise that people are turning to WealthTechs for their investing and saving needs. But how much has the WealthTech sector grown, especially in Europe? Let’s take a deep dive into the insights in the following sections.

WealthTech Insights; European Market Growth

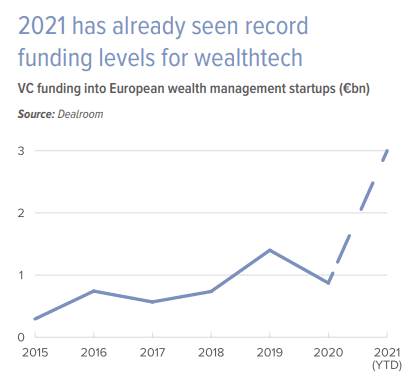

What better way to examine market growth than visually through a graph. The graphs below, two of which are from sifted’s WealthTech report, show a clear trend – the sector has grown tremendously over the last couple of years and has produced some heavyweight FinTech unicorns.

The graph shows the incredible amount of funding that European WealthTechs received over the years, in 2021 this skyrocketed.

The following graph confirms this tremendous growth trend in particular when comparing the number of deals and amount of funding that went into European WealthTech between Q2 2020 and Q2 2021.

The final graph of the section…I promise, examines the insights produced by individual WealthTechs, in particular the European trading platforms. Attracting customers with low trading fees and a simple, easy-to-navigate app design, it is no surprise that these have amassed jaw-dropping valuations as a result.

Having looked at some of the mind-blowing figures that European WealthTechs have produced over the last couple of years, let’s take a closer look at some of the key players.

WealthTech Insights; Take My Money Already

It’s fair to say that at this point, European residents are almost spoilt for choice when it comes to investment and/or savings apps. Let’s not forget to mention the rise in popularity of crypto over the last few years and as a result, the abundance of crypto WealthTechs that have sprung up – like tulips in April…shoutout to our Amsterdam-based team.

Here are some of our favorite European WealthTechs, that have put the power of investing and saving into consumers’ hands. As in the previous three to four insights articles, these are in no particular order.

Scalable Capital, not only a robo-advisor but on their way to becoming Europe’s leading digital investment platform.

Munich, Germany

Founded in 2014

Series E

Total Funding Amount: €266 million

Valuation: $1.4 billion

The digital broker and investment platform enables millions of Europeans to grow their money through easy, secure, and free access to financial markets.

Berlin, Germany

Founded in 2015

Series C

Total Funding Amount: $995.5 million

Valuation: $5.3 billion

A Dutch cryptocurrency exchange and investment platform.

Amsterdam, The Netherlands

Founded in 2018

Private

An Austrian digital investment platform enabling users to invest in cryptocurrencies, stocks, ETFs, crypto indices, and precious metals.

Vienna, Austria

Founded in 2014

Series C

Total Funding Amount: $546 million

Valuation: $4.1 billion

The Dutch neo broker makes investing in stocks, crypto, fractional shares, and ETFs available in one app.

Amsterdam, The Netherlands

Founded in 2014

Series C

Total Funding Amount: $115.8 million

Valuation: ~ €400 million

With this article only being a sneak peek behind the European WealthTech curtain, we’re confident that in the next years more and more phone home screens will be plastered with investing and savings apps. Filing tax returns will probably mean an avalanche of WealthTech monthly statements in PDF format flooding upload buttons. But we’re excited, excited to watch a sector continue to grow that has truly revolutionized the investing and savings landscape.

Your Partner in Growth

As the FinTech industry continues to grow, so does the need for talent to facilitate this. At Storm2 we have specialized in connecting FinTech talent with disruptive FinTech players such as yourself. We are able to assist in any stage of your growth by connecting you with the right people. Please don’t hesitate to get in touch and we would be more than happy to see how we can help and support you in your journey.