The WealthTech industry is one of the most popular verticals within FinTech. More people are turning to WealthTech apps for services such as portfolio management and micro-investments. With well-designed and easy-to-navigate apps, WealthTech has made investing and saving more accessible by using technology to deliver more cost-effective products for advisors and consumers.

But what is WealthTech?

Definition of WealthTech

In simple terms, WealthTech refers to the use of innovative technologies such as artificial intelligence and Big Data to make wealth management and investment services more efficient and automated.

Before we jump into the different types of WealthTech apps and their benefits, it is important to understand the evolution of the WealthTech market.

How the WealthTech market has evolved?

The WealthTech market has evolved due to the creation of ‘Robo advisors’ in the early 2010s. Robo advisors offer financial advice or investment management online with little to no human interaction. This leads to consumer attitudes shifting towards more real-time digital apps and custom portfolio options, creating opportunities for investors to help the WealthTech industry innovate.

The pandemic has accelerated the process of wealth management apps because it drove everyone to move online—even those resistant to the digital transformation ultimately had no choice!

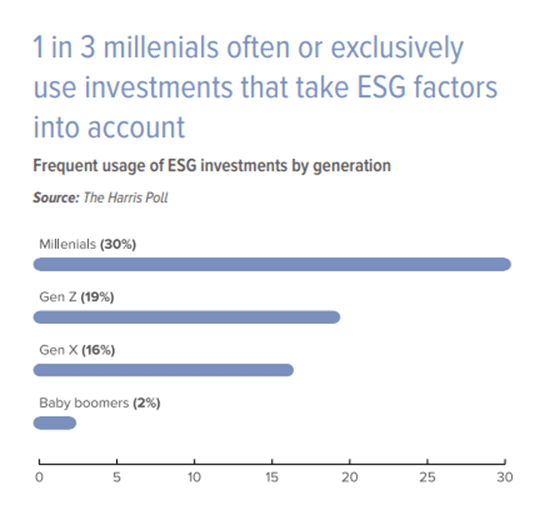

Now investing has become as simple as downloading an app and letting AI monitor your portfolio. So, it is no surprise that WealthTechs have resonated with millennial investors and consumers. And for a good reason, as Sifted reported, almost 12% of the UK adult population now uses at least one investment app.

The future of WealthTech may focus on new technologies and easy-to-use mobile apps that promote financial inclusion. When we consider the current technologies that WealthTech has introduced to the FinTech sector, there will likely be many new and innovative advances. It is therefore reasonable to predict that WealthTech apps will eventually replace traditional financial advisors!

What areas of WealthTech are popular?

Robo advisors, Robo retirement, micro investing and digital brokerages are examples of WealthTech categories that have significantly grown in popularity.

Robo-advisors

Robo-advisor apps such as Wealthfront and Scalable Capital benefit the new types of investors who are millennials, and these apps offer inexpensive and accessible advice. Nowadays consumers have a plethora of investing and savings apps which offer more flexibility and security to users at the click of a download button.

Robo retirement

Robo retirement apps have proved highly popular in this sector. Companies within this category specialise in managing consumers’ retirement savings. A notable mention would be Pension Bee, a Robo retirement app where you can combine your pensions within their mobile app.

Micro-investing

Micro-investing is another exciting area that has levelled the playing field for consumers to take part in investment opportunities. The Stash app is a goal-based digital investment platform that allows investors to contribute as little as $5. Another benefit of micro-investing apps is that they educate consumers by offering guidance, recommendations, and explanations about investments.

Digital brokerage

Digital brokerage is another category that’s steadily increasing in popularity. They enable access to stock market information and investment for experienced and beginner investors. ‘Social trading’ helps financial managers to make sound decisions based on data provided by social trends and digital brokers. For example, eToro allows beginner investors to “copy” trades executed by more experienced investors.

Key Trends in WealthTech

Based on the changes that the wealth management market has undergone and the evolving changes in clients’ expectations, I have defined two key trends in WealthTech: the rise in millennial investors and DIY investing.

The rise in Millennial investors

There has been a rise in millennial investors whose needs for efficiency and convenience are met by WealthTech apps that they can easily download. Investors are attracted to learning how to invest and trade as WealthTech apps have made information more accessible. Businesses like Revolut and Moneybox attract younger audiences because of their ease of access and simple UX design.

“Do It Yourself” Investing (DIY investing)

WealthTech Apps empower investors to manage their own money and trade securities through self-directed online platforms. Consumers demand more control and accountability regarding their investments. In addition, the apps have increased the confidence of investors ‘doing it themselves’. As WealthTech evolves and becomes more integrated into daily life, it will continue to encourage more individuals to take charge of how they invest.

More importantly, how do these trends benefit you?

- These WealthTech trends benefit start-ups as increased interest in their disruptive ideas allows them to access more funding and new markets. As the Dolfin Research shows that in the first quarter of 2019 alone, around $2.5 billion was invested in WealthTech start-ups. This was more than half of the $4.6 billion invested in 2018.

- The WealthTech trends also benefit the wealth managers who adopt these new technology solutions. It will bring new capabilities to their offerings and allow them to engage with the up-and-coming millennial investors.

- Investors benefit from these trends as they can automatically build sophisticated portfolios using WealthTech apps which empowers them to take control of their financial planning.

Suppose all that information hasn’t convinced you enough about the benefits of WealthTech apps. Below are notable WealthTech companies we work with and more information about other awesome WealthTech apps you should check out.

Syfe, Finitive and Halo are all amazing WealthTech apps that have partnered with us.

SYFE, Central Region, Singapore | Founded in 2019

Series B – $51.9M

Syfe combines leading investment strategies with cutting-edge technology to help investors with better investment outcomes. Unlike traditional investment management, there are no high fees or hidden costs.

Finitive, New York, United States | Founded in 2017

Corporate Round- $8M

Finitive is the leading data-driven private credit marketplace that helps borrowers streamline and accelerate the private credit transaction process from investor sourcing to closing. Many borrowers have increased their existing capital base through Finitive, transforming their businesses and creating substantial shareholder value. Finitive has had a total funding of $8M.

Halo, Illinois, United States | Founded in 2015

Series C – $115.1M

Halo Investing is a financial technology platform that provides structured note investments to the average investor.

Wealthfront, California, United States | Founded in 2011

Series E – $204.5M

Wealthfront provides an automated investment management platform that allows investors to create and manage personalised investment portfolios at a lower cost. In addition, Wealthfront offers a competitive 0.25% management fee.

InvestCloud, California, United States | Founded in 2010

Private Equity Round- $54.1M

InvestCloud creates beautifully designed client experiences and intuitive operations solutions using an expanding library of digital modular apps. The company has a total funding of $54.1 million. It supports more than $2 trillion of assets for over 700 clients and supplies digital solutions pre-integrated into the cloud to companies operating across the entire investment management value chain.

FinMason, Massachusetts, United States | Founded in 2013

Angel Round- $6.5M

FinMason is a data redistribution and provider of investment analytics engines for financial services platforms. Their total funding is $6.5M.

Robinhood, California, United States| Founded in 2013

Post IPO secondary round- $6.2B

Robinhood is a commission-free stock trading and investing app that aims to help shape consumer’s financial future. Robinhood’s current valuation stands at $11.7billion.

Scalable Capital, Munich, Germany| Founded in 2014

Series E – €266M

This Munich-based WealthTech is one of Europe’s most promising digital investment platforms. A benefit of Scalable Capital is that they use evidence-based historical data rather than predicting future market movements.

Trade Republic, Berlin, Germany | Founded in 2015

Series C – $995.5M

The German neo broker is a commission-free mobile broker that enables millions of Europeans to grow their money by offering users savings plans, stocks, and more.

Moonfare, Berlin, Germany| Founded in 2016

Private Equity Round- $201.4M

Moonfare is the leading global platform for private equity investing. The app helps investors achieve extraordinary results through careful fund curation and a seamless digital experience.

As the WealthTech industry continues to grow, so does the need for talent to facilitate this. At Storm2 we have specialized in connecting FinTech talent with disruptive WealthTech players such as yourself. We can assist in any stage of your growth by connecting you with the right people. Please don’t hesitate to get in touch with our WealthTech recruiters and we would be more than happy to see how we can help and support you in your journey.